Military Child Support Pay Chart

Military service has regulations when it comes to military divorce and separation especially when it comes to spousal and child support.

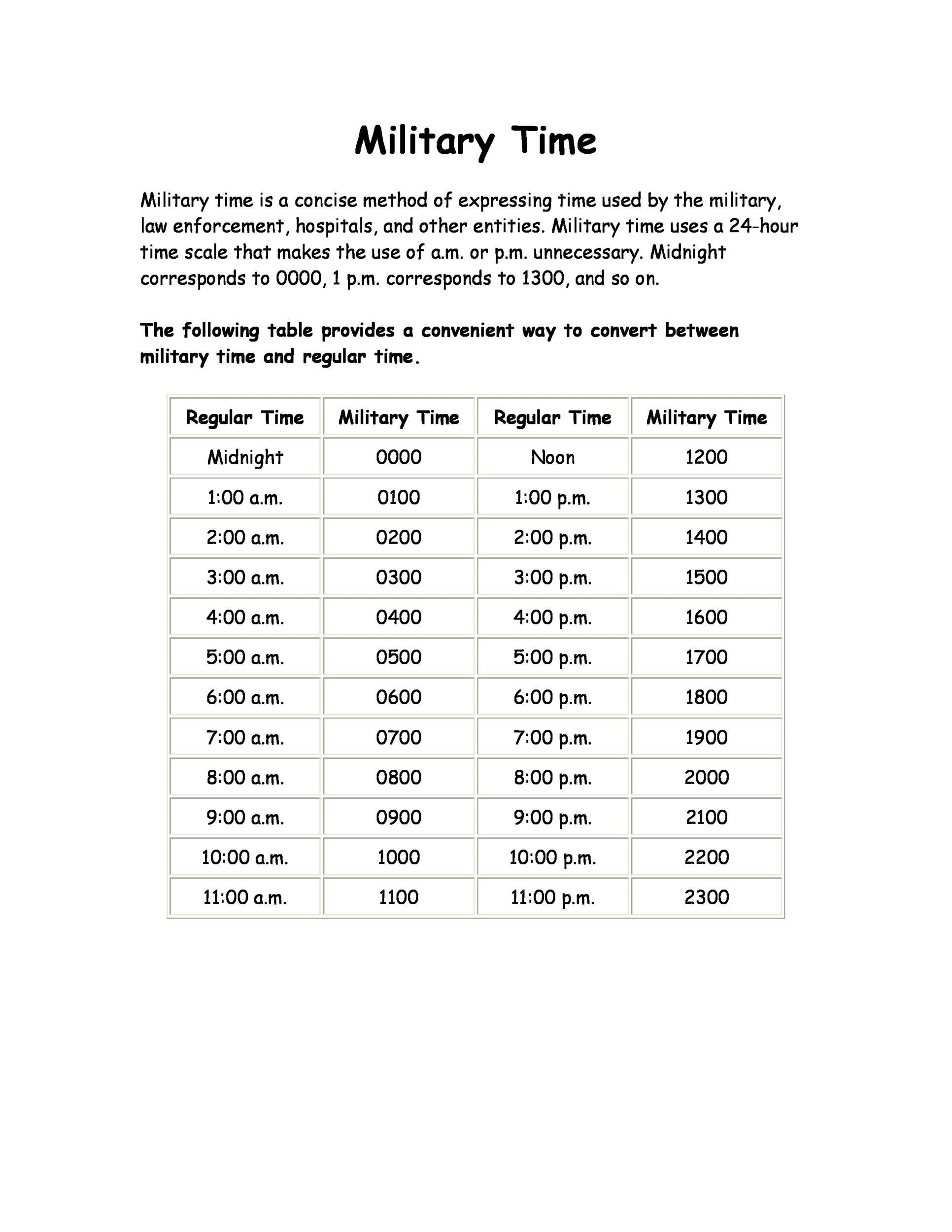

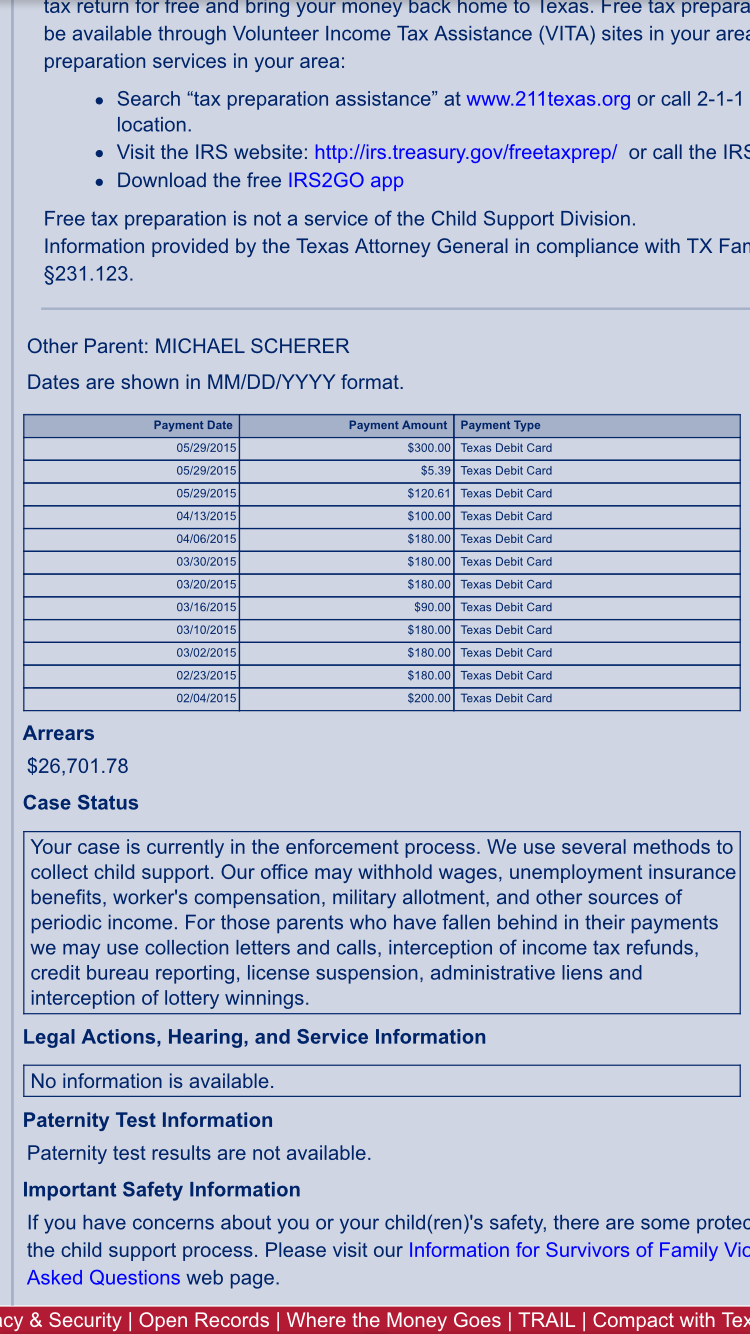

Military child support pay chart. Base pay is the same across all service branches and is based on rank and time in service with pay raises according to years of creditable service. This article can help you find your way. 1673 limits the amount that can be deducted as child support or alimony from earnings.

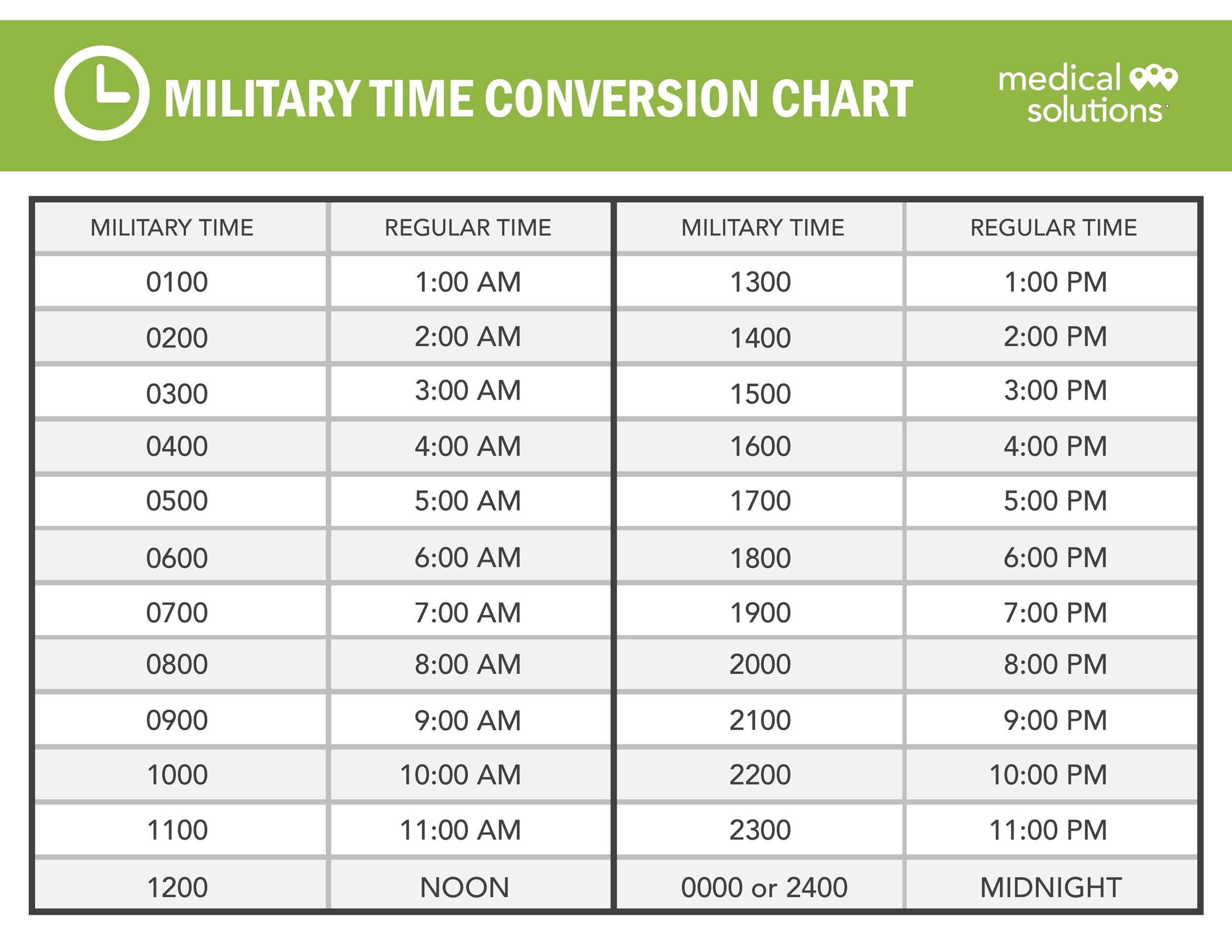

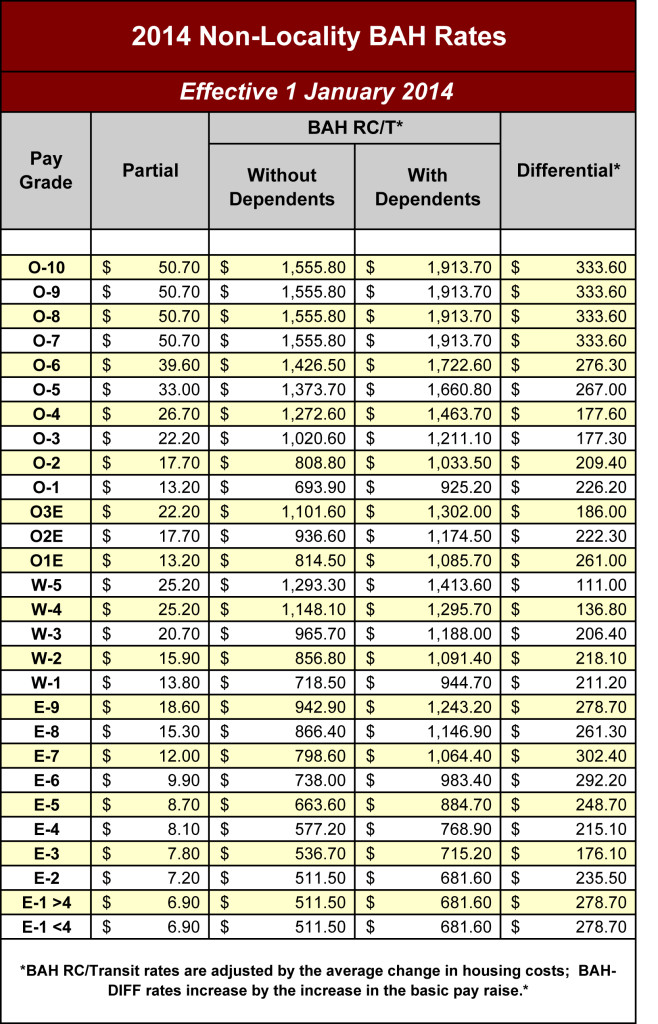

All payments are based upon bah ii and is the housing allowance without the locality allowance found on page 2 of the military pay chart. Military pay can seem complicated until you understand that military pay comes from two basic sources. If the parent who must pay child support is in the military it can be challenging to calculate the proper amount.

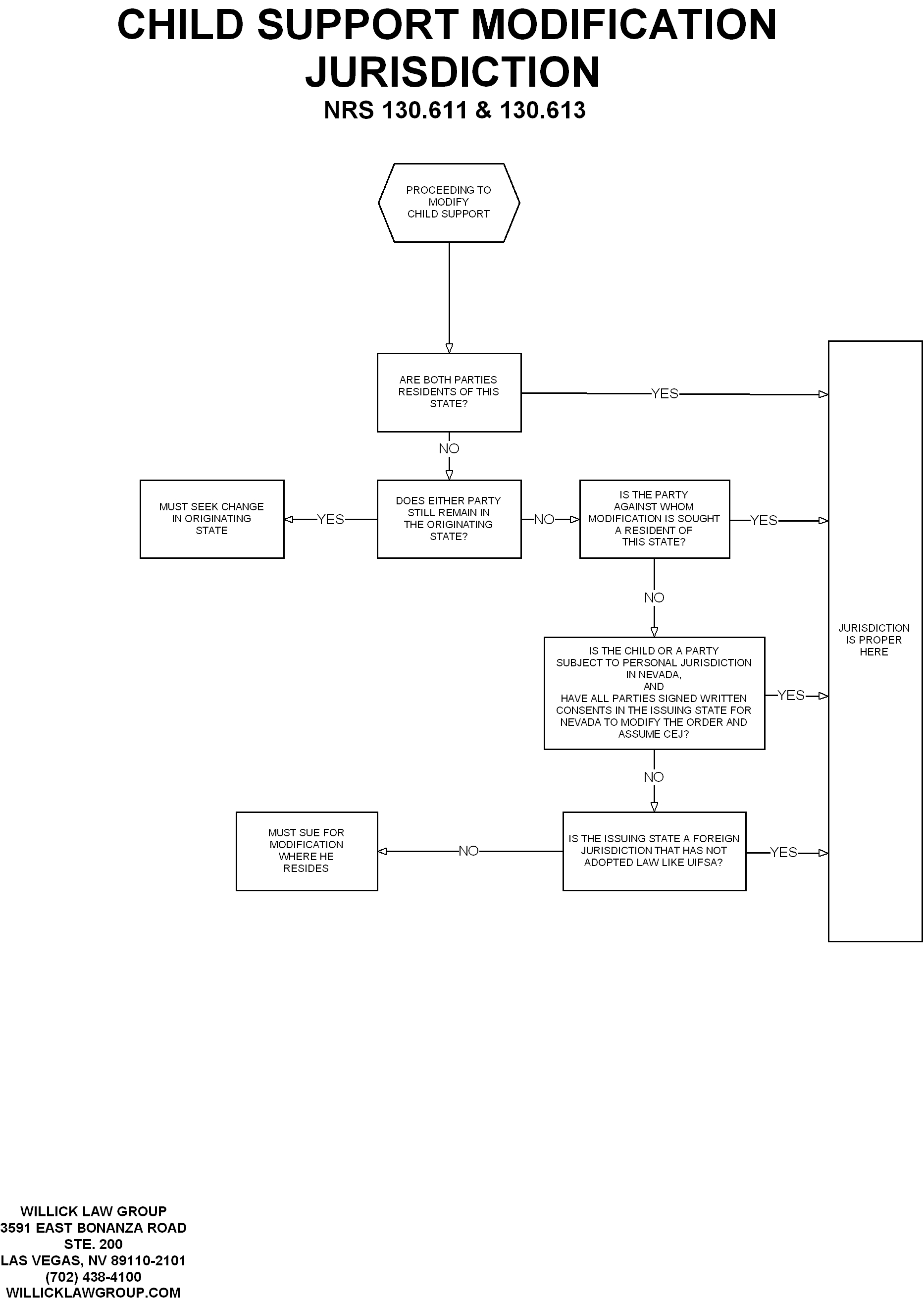

If you and the other parent can t agree on the support amount and a. To calculate a reasonable amount of child support start with your state s child support guidelines. Find your basic allowance for housing rates the following tables.

Child support calculation for service members. Base pay and special pays. These regulations require members to provide adequate support to family members but without a court order the military can t compel a member to pay support.

The calculator includes all regular military compensation rmc including base pay bah bas and which portions that are taxable and tax free. When you are not relying on a military interim measure to determine the amount of child support obligation the calculation of the required child support payments is the same for a service member as it would be for a non military service member and is based primarily on income. The limit ranges from 50 percent to 65 percent of disposable earnings the full ordered amount of child support or alimony will be deducted as long as that amount does not exceed the maximum percentage allowable.

The consumer credit protection act 15 u s c.

/black-girl-hugging-leg-of-returning-soldier-546826929-5838b32f3df78c6f6afd1323.jpg)

/understanding-military-pay-3356713-Final-14fc6a0ccd3a4743b591b8d546932823.png)

:max_bytes(150000):strip_icc()/Balance_Active_Duty_Enlisted_Basic_Military_Pay_Charts_3343824_V1-d2044d39e5c5474abf1b280f1737a278.png)