Utma Age Of Majority By State Chart

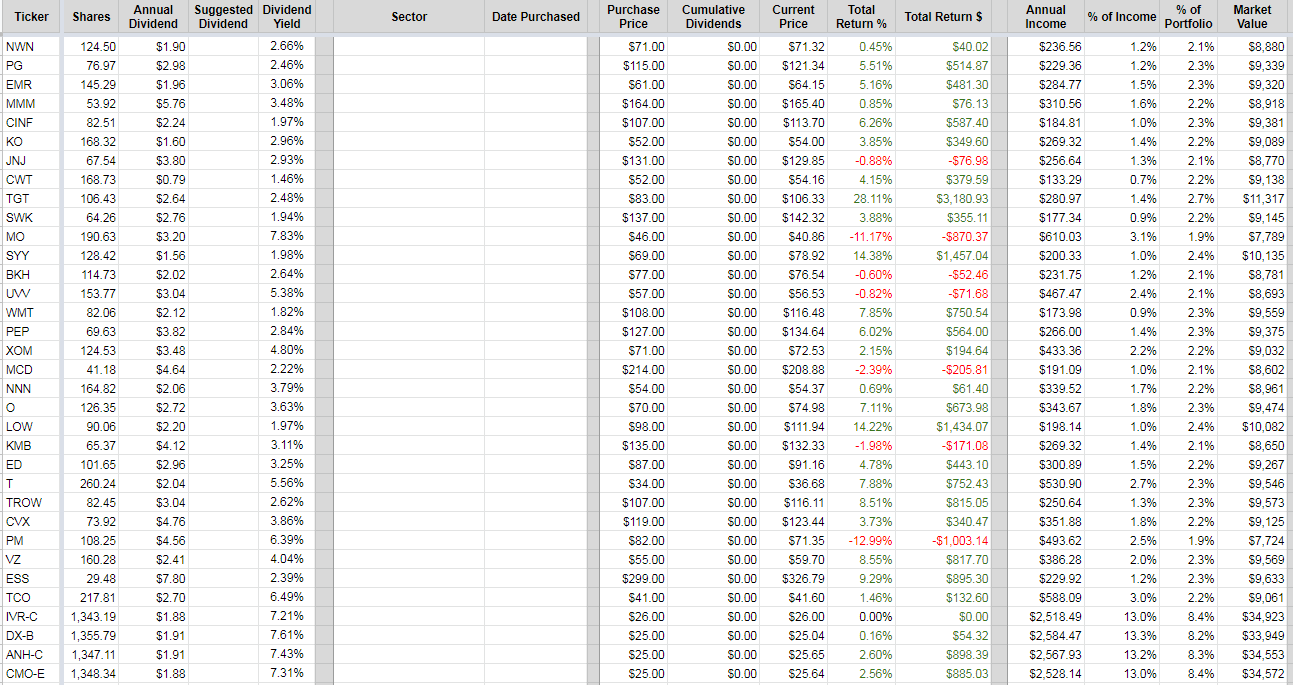

The adult can then add money to the account and choose investments.

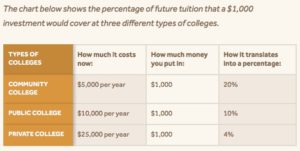

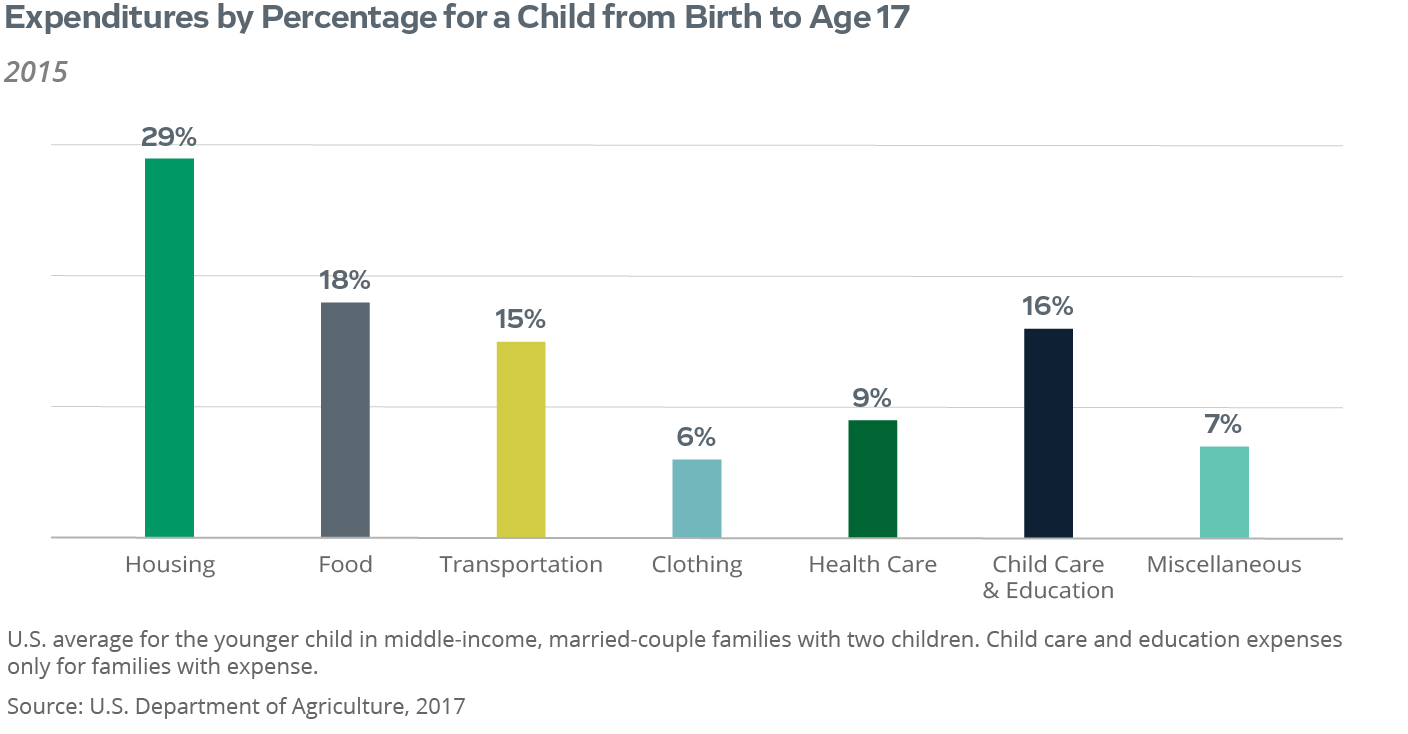

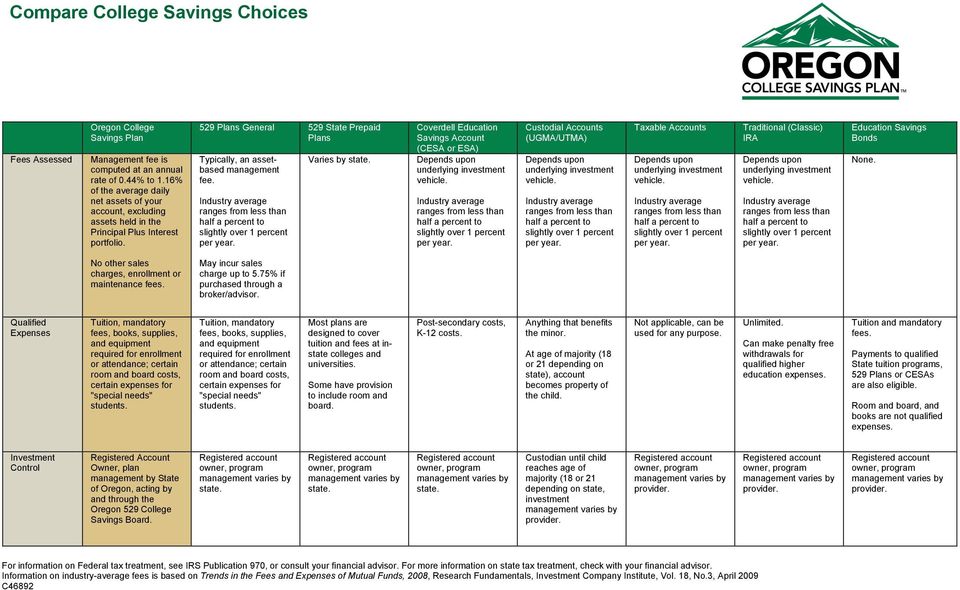

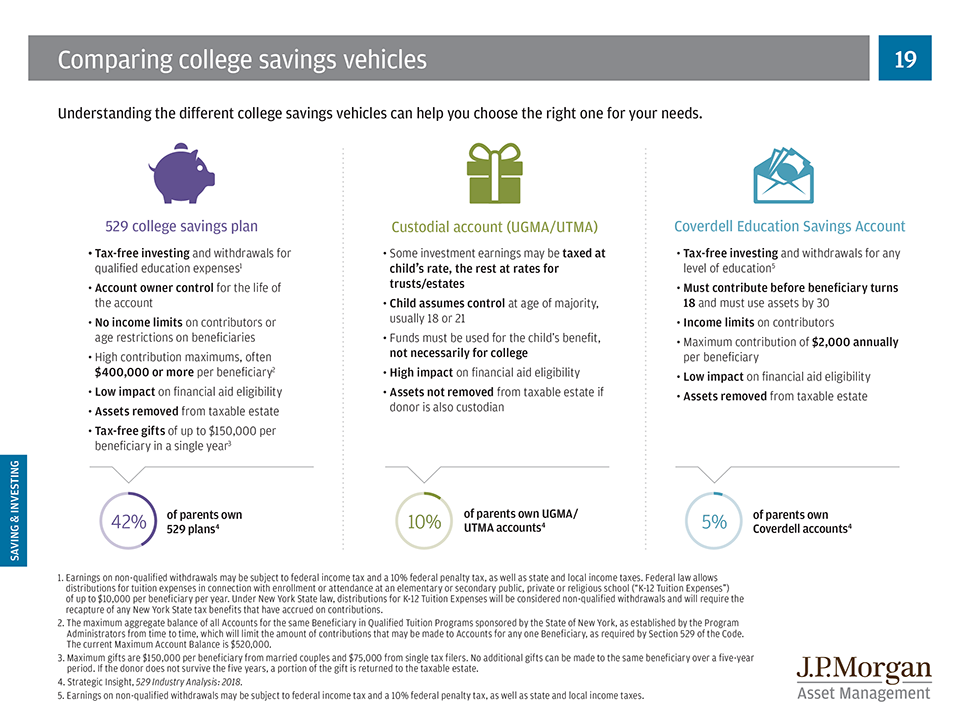

Utma age of majority by state chart. The utma was finalized in 1986 by the national conference of commissioners on uniform state laws and adopted by most of the 50 states. For child support purposes the age of majority is 18 in most states 19 in alabama colorado maryland and nebraska and 21 in d c indiana mississippi and new york with exceptions for a later age of majority if the child is still in secondary school the age of termination for ugma and utma accounts is listed in the following table note that some states permit the transfer to occur at a later date if this is specified in the titling of the account. All of the states in the table have enacted utma statutes except for south carolina and vermont which still operate under ugma statutes.

This age varies from state to state but in most states the age is 18. Up until the age of majority you are considered a minor a child. In most states the age of adulthood is defined separately for custodial accounts.

The age of majority in most states is 18 years old. The age of majority is the age at which you are considered an adult and responsible for your actions in the legal sense. The age of consent is age 16 17 or 18 depending on the state.

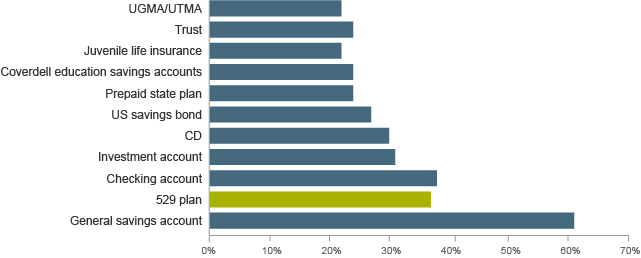

Puerto rico does not have an ugma or utma statute. The following chart lists the ages of majority in the states in the seattle region. The uniform transfers to minors act utma allows you to name a custodian to manage property you leave to a minor.

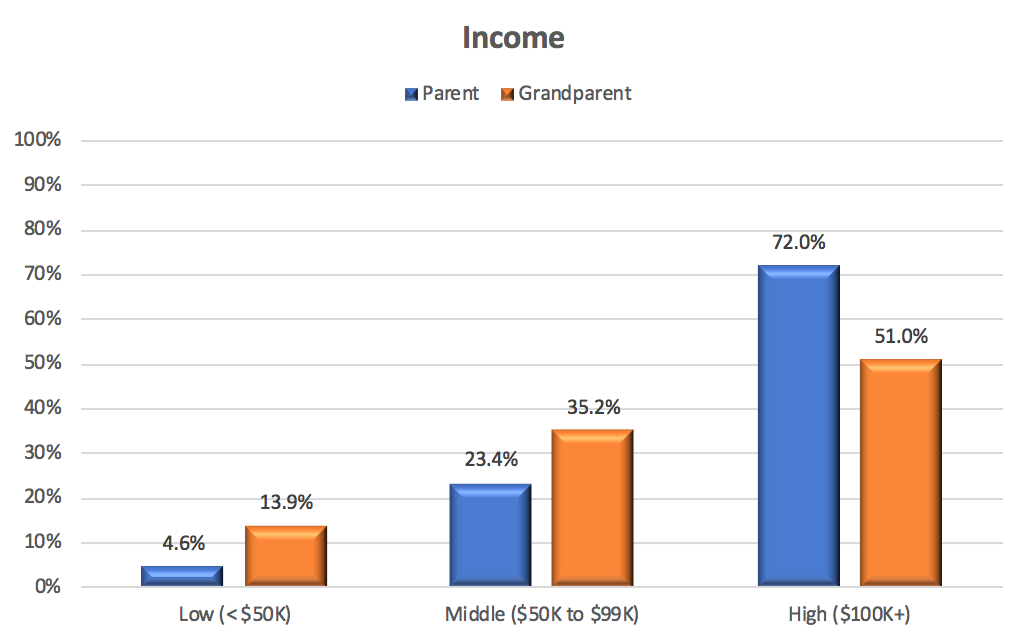

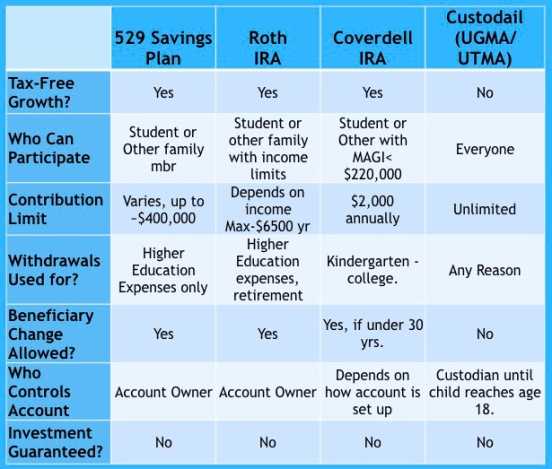

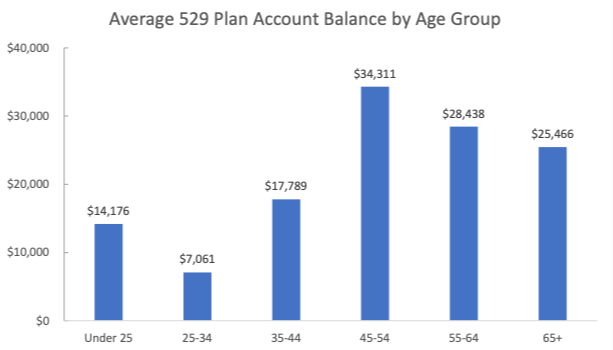

The age of majority varies by state but is generally between 18 and 25. The age is designated by the state statute where you set up the utma account. The utma is a model law proposed by a group of legal scholars and states are free to adopt it into their own statutes or not.

In some cases it s called the age of trust termination. When the child reaches the age of majority specified by the state control of the account must be transferred to them. The age of majority is when a child becomes an adult in the eyes of the law.

Any unused money must be distributed by the time the child reaches the age of majority or the maximum age allowed for custodial accounts in their state. For example in massachusetts if the property is gifted to billy he will receive the money at age 21. Per si 01120 205 a gift made under utma ugma is neither income nor a resource to the minor until he or she attains the age of majority as defined by state law.

The age of majority and the age of trust termination vary by state and are shown in this table. With some exceptions a minor can t receive the funds in an utma account unless she is at least 21 years old. It allows minors to receive gifts and avoid tax consequences.

/living-trust-documents-483615849-5c7bd28146e0fb0001edc855.jpg)

/ideas-make-changes--edison-light-bulb-on-the-sky-1127308014-bedcf3b08d814bc1b49cd61db544efad.jpg)

/GettyImages-185239034-5b6a4ab5c9e77c0050f5bbe2-5bf346be46e0fb00265801e4.jpg)

/financial-advisor-with-digital-tablet-meeting-with-family-in-kitchen-944063692-6726064dbc78409095839f1de93b93bc.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-909597900-2f43ef842d5b4f35b831bc03602193f0.jpg)