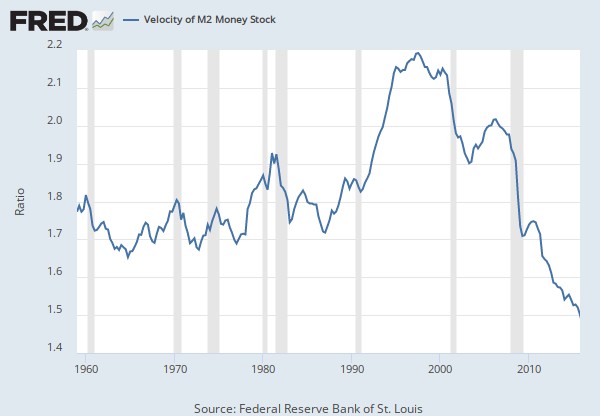

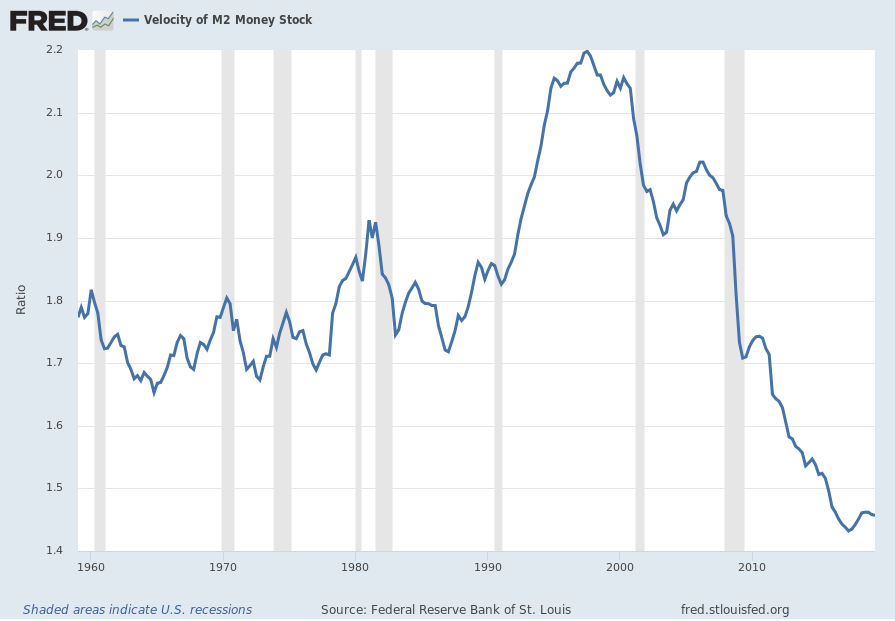

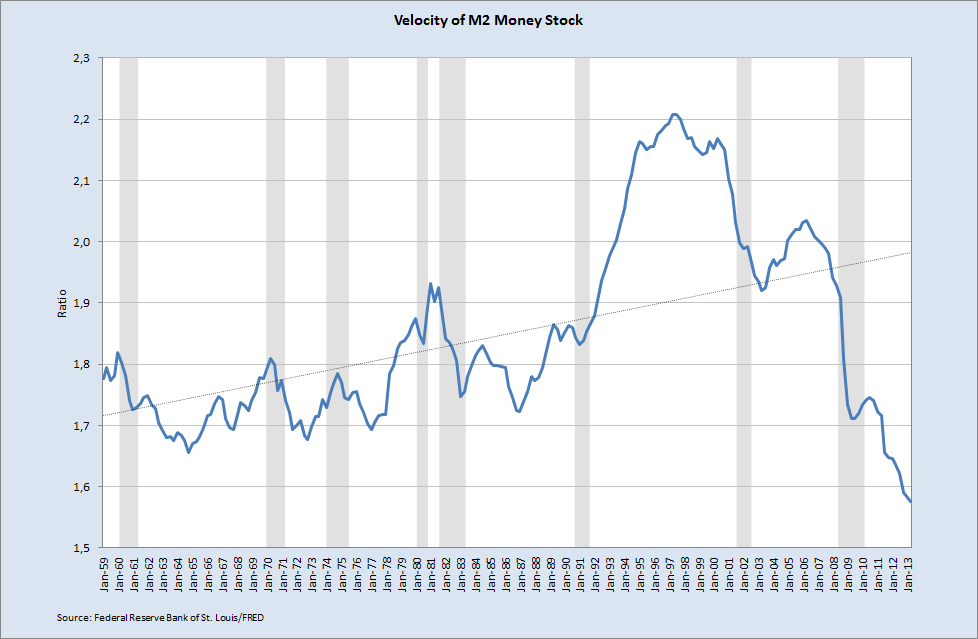

Velocity Of Money Chart

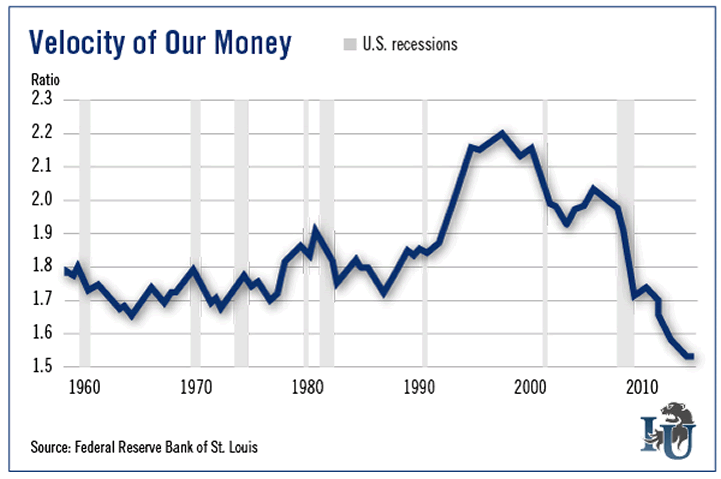

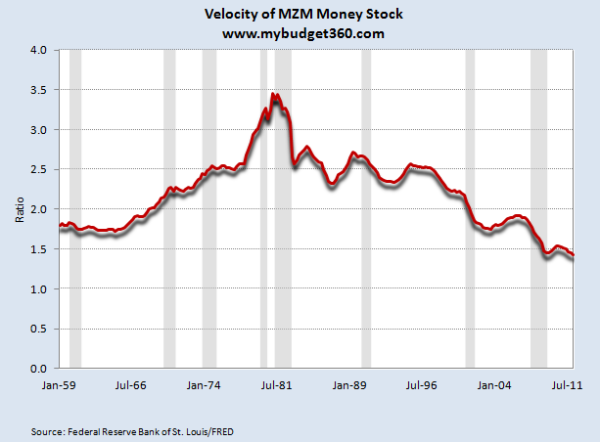

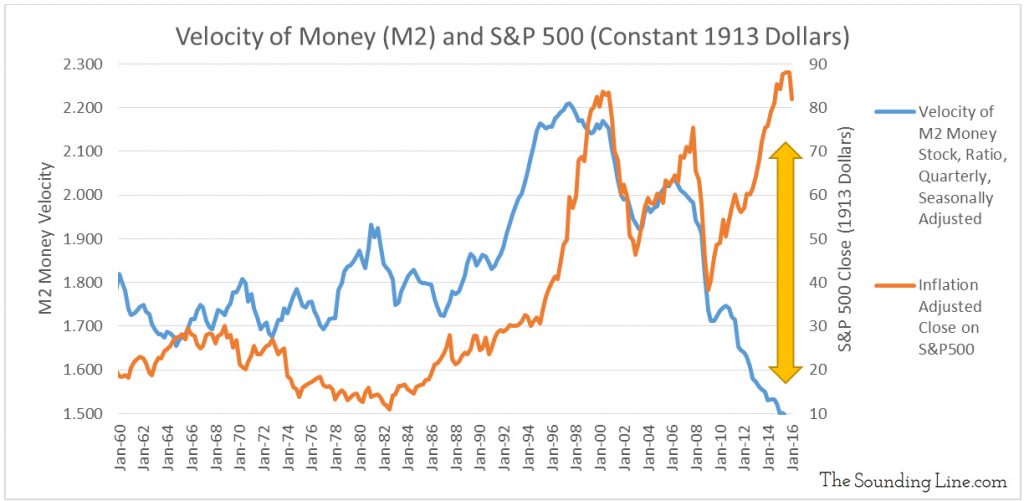

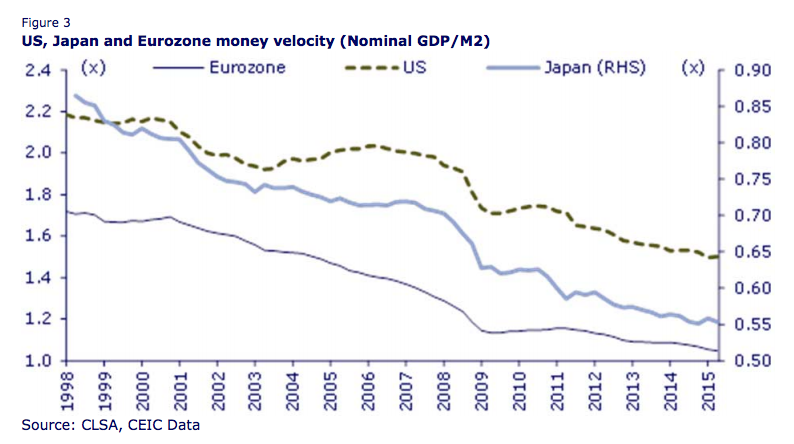

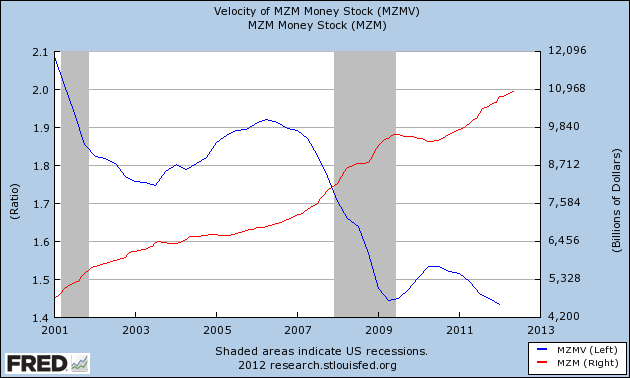

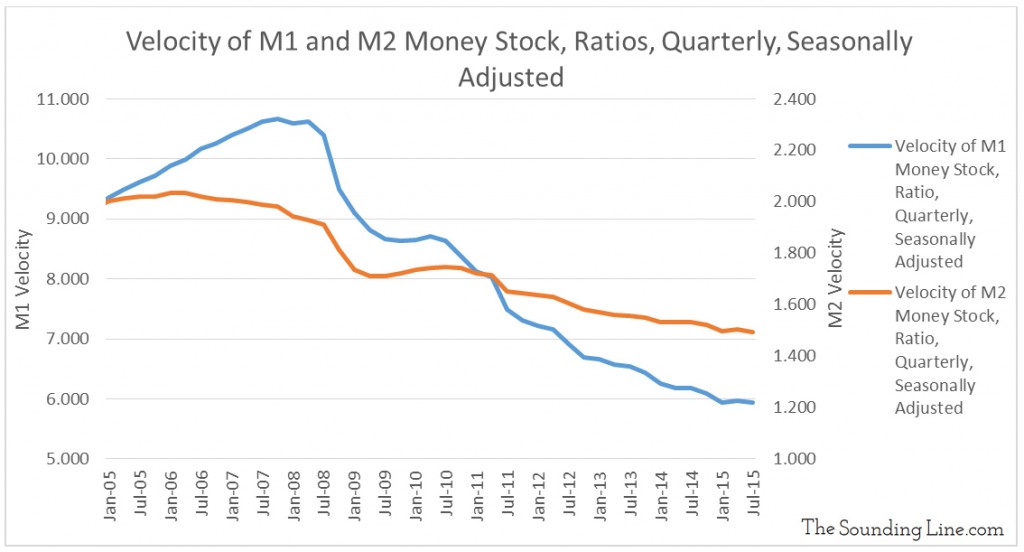

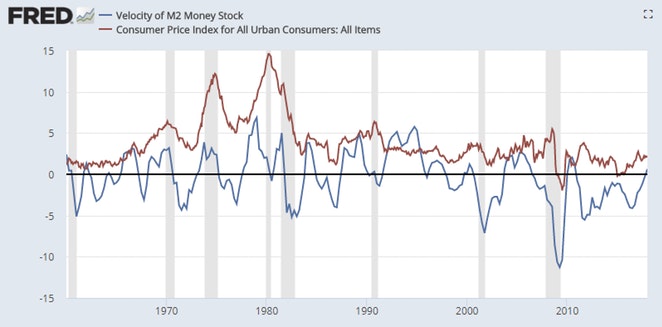

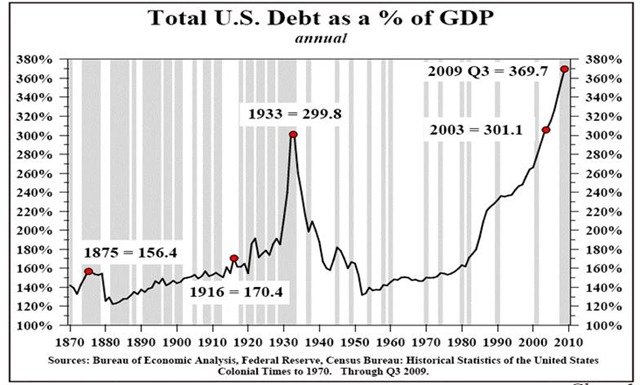

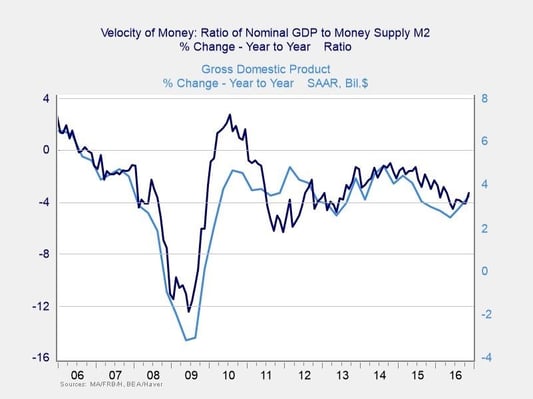

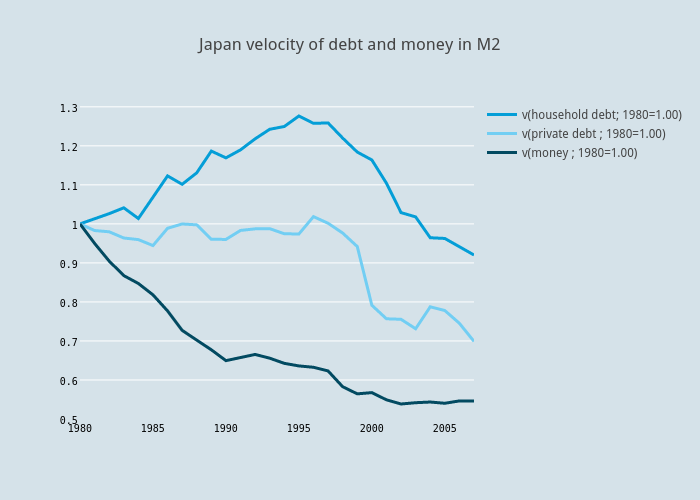

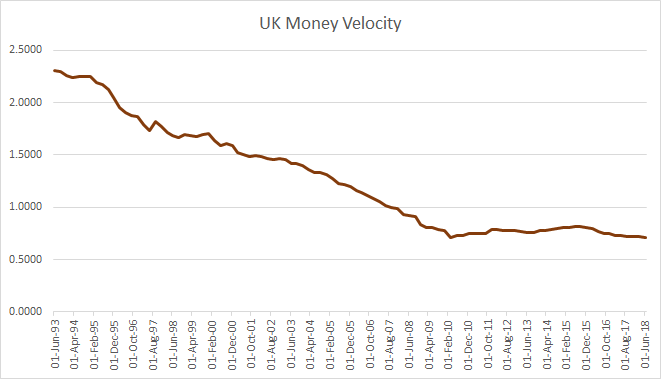

Instead the money has gone into investments creating asset bubbles.

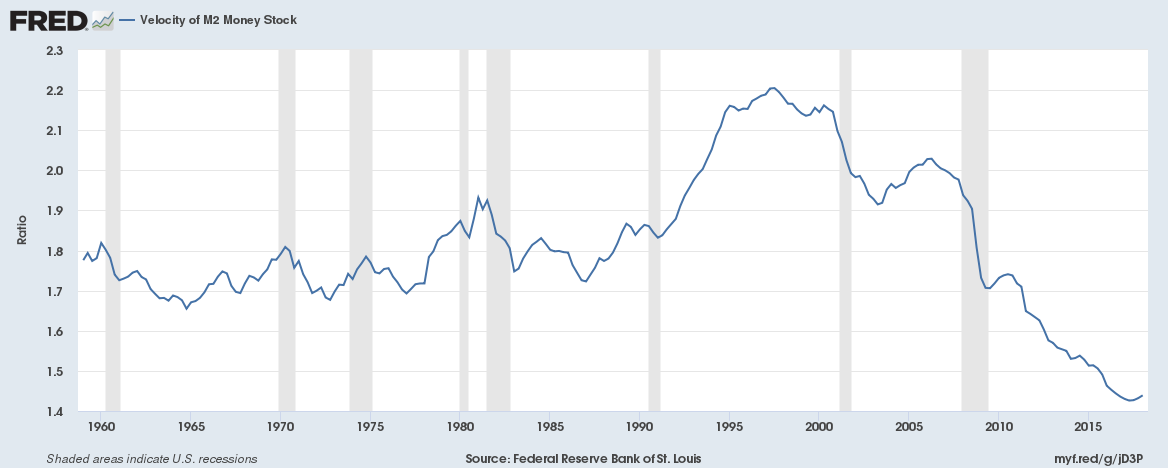

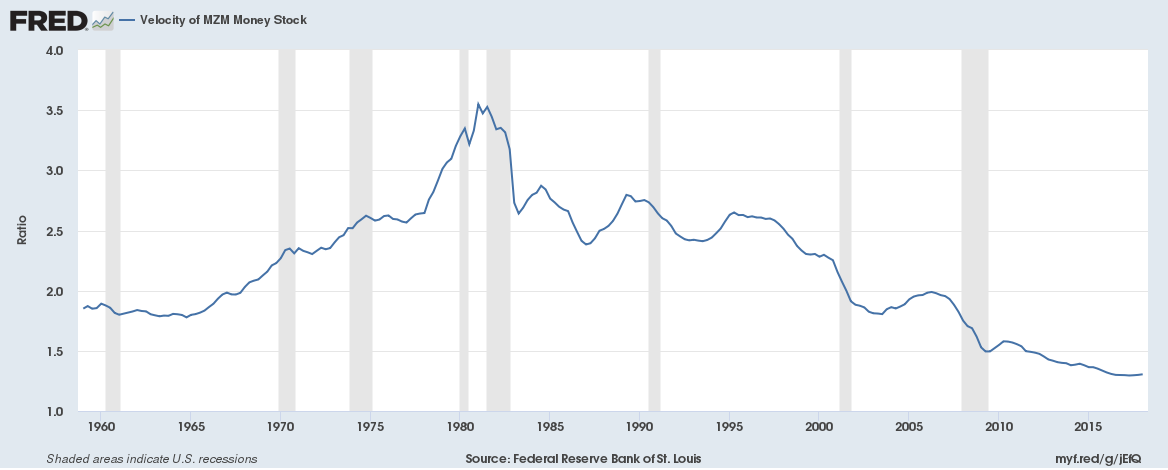

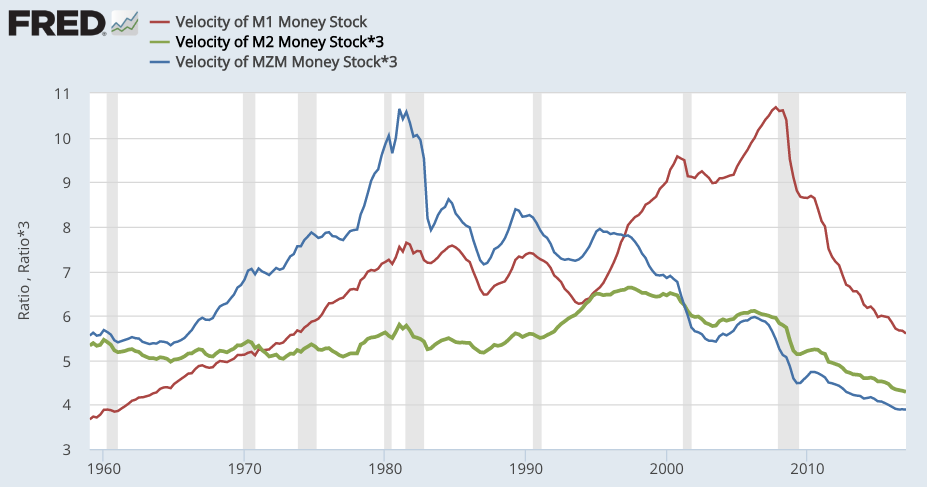

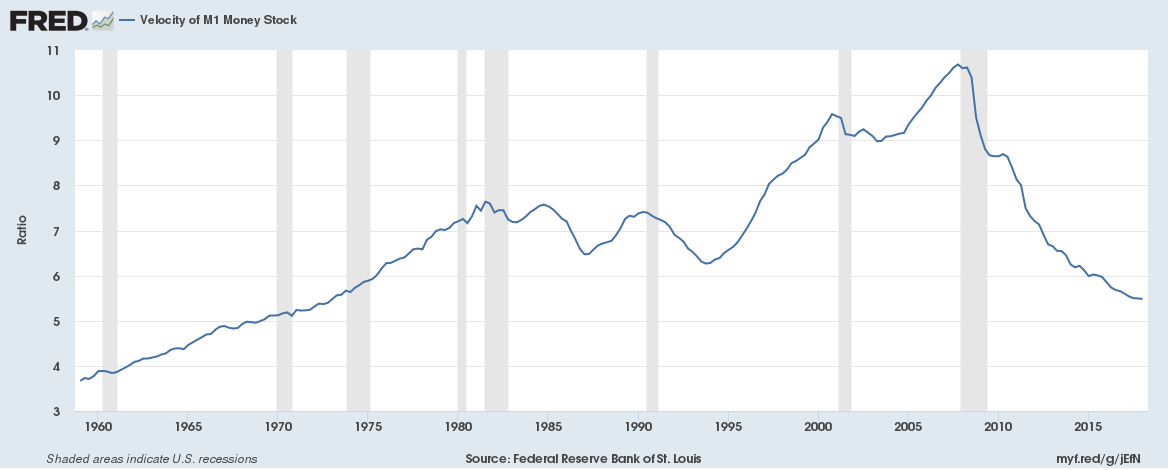

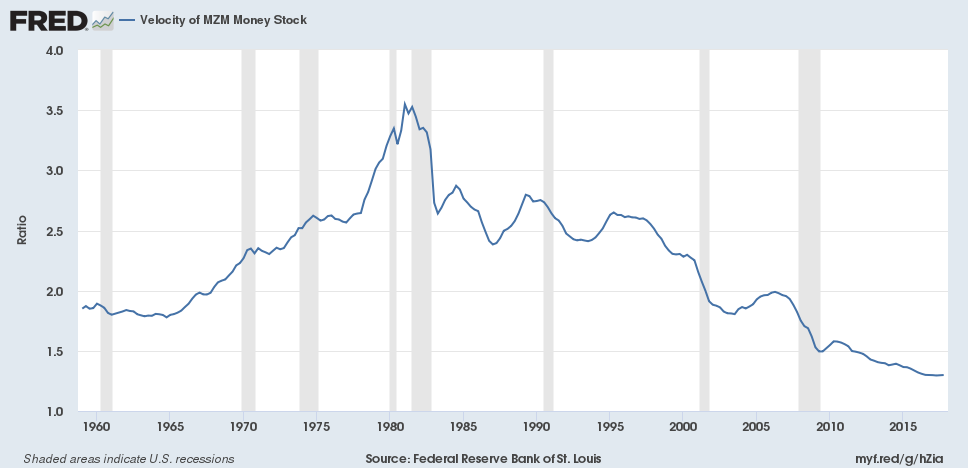

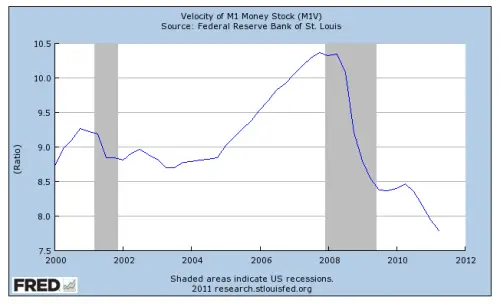

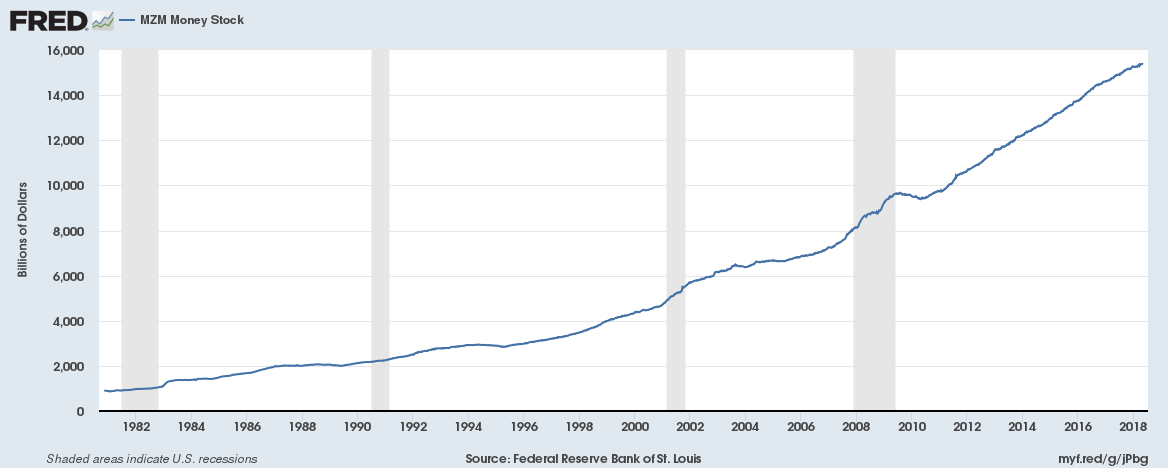

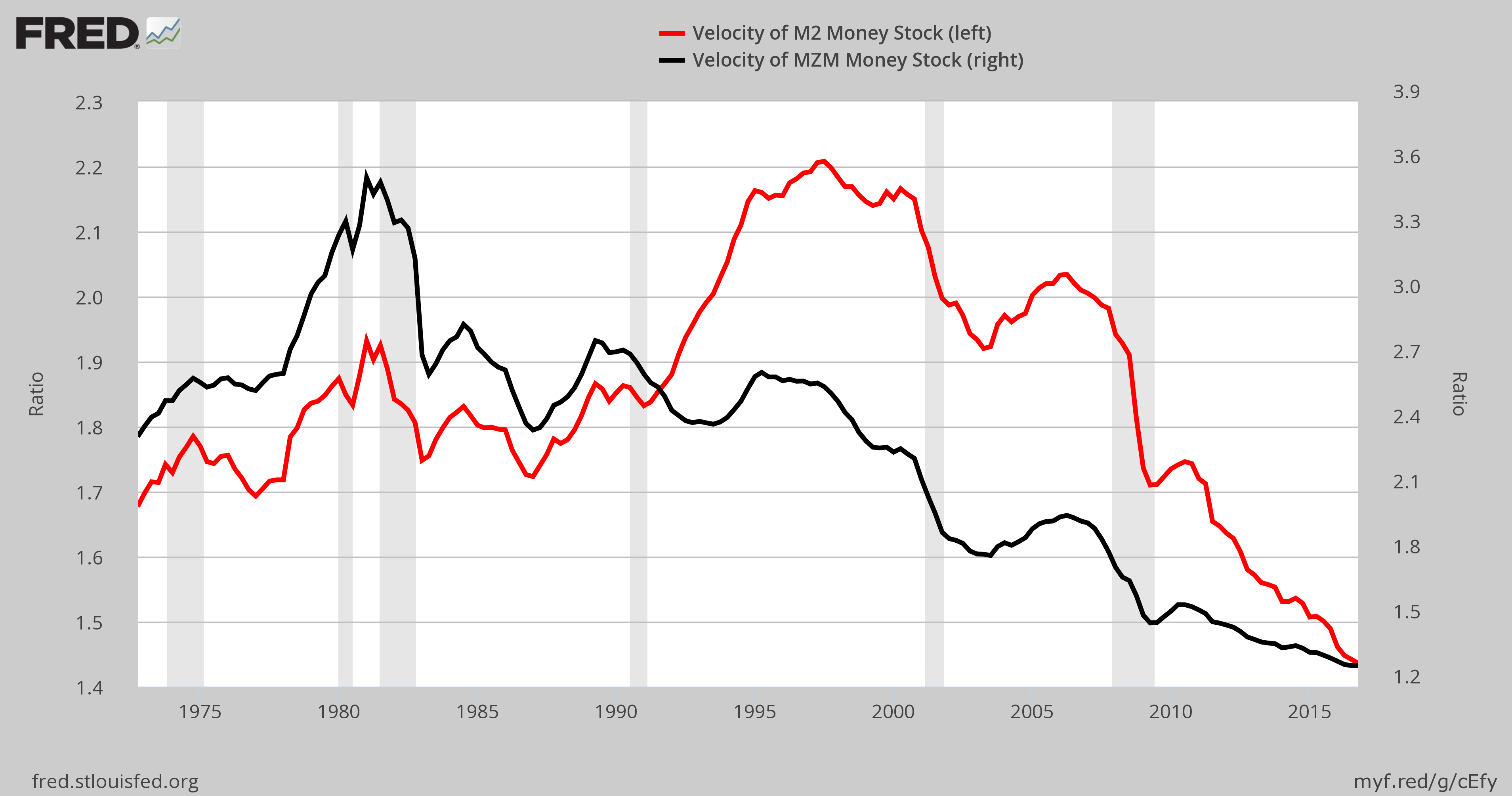

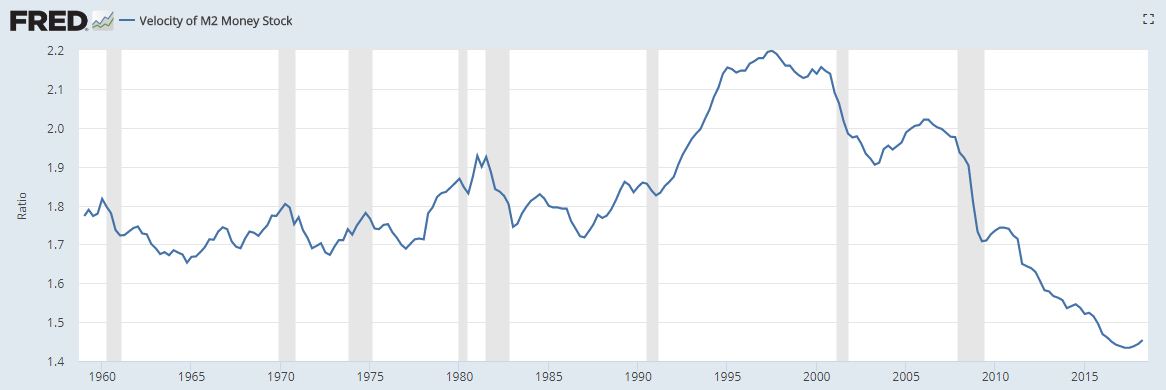

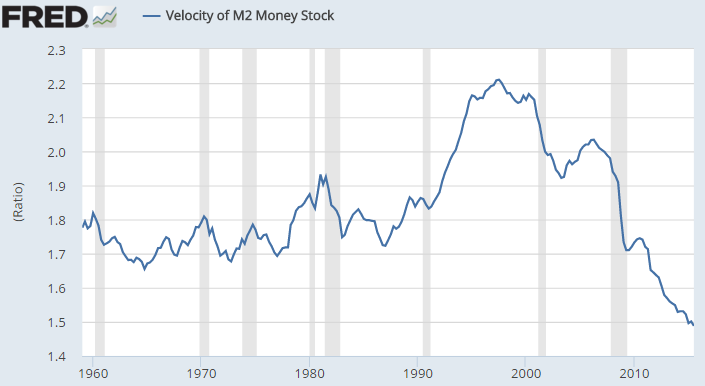

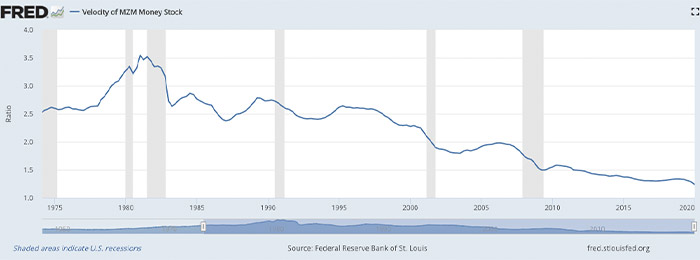

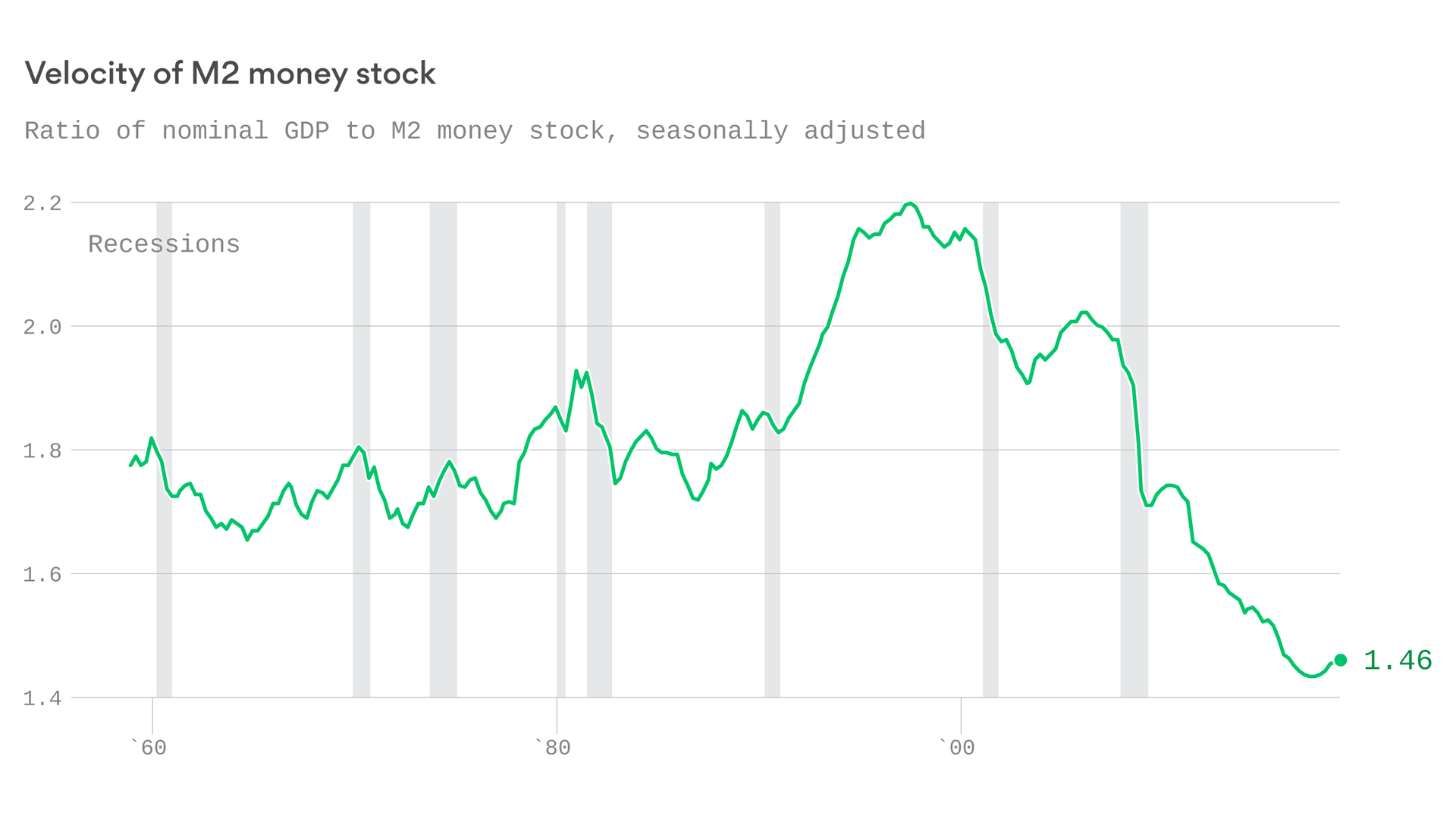

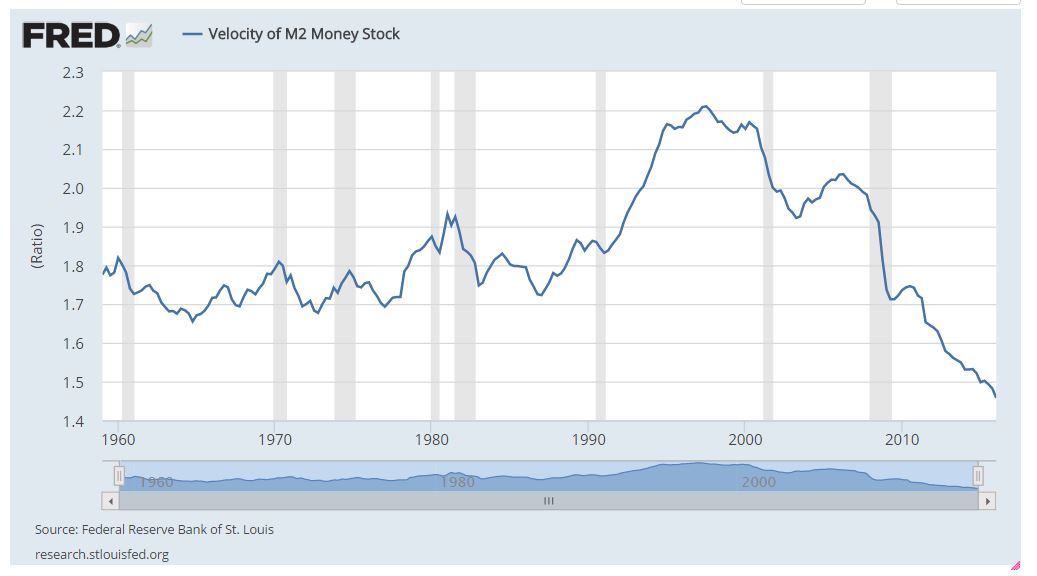

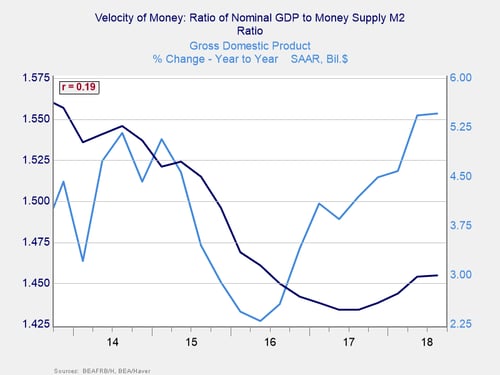

Velocity of money chart. Velocity of money chart. We are given both the nominal gross domestic product and average money circulation we can use the below formula to calculate the velocity of money. Velocity of money charts updated through april 29 2020 april 29 2020 by ted kavadas here are three charts from the st.

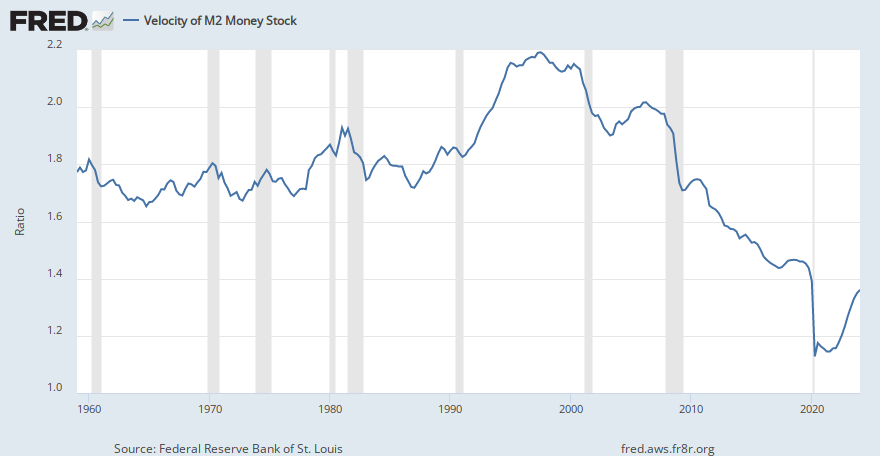

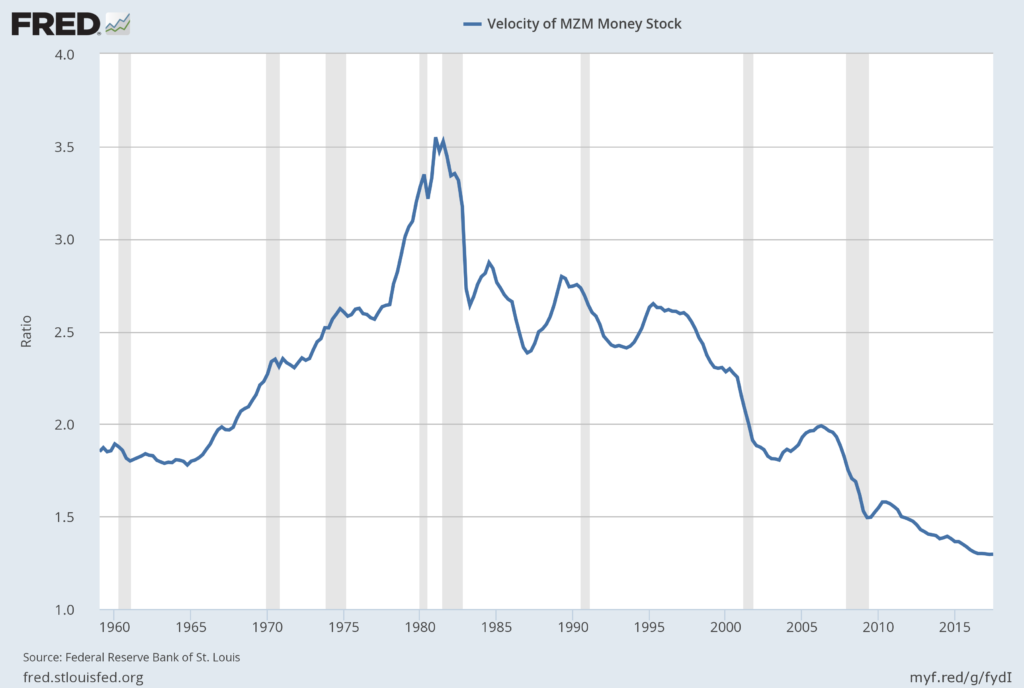

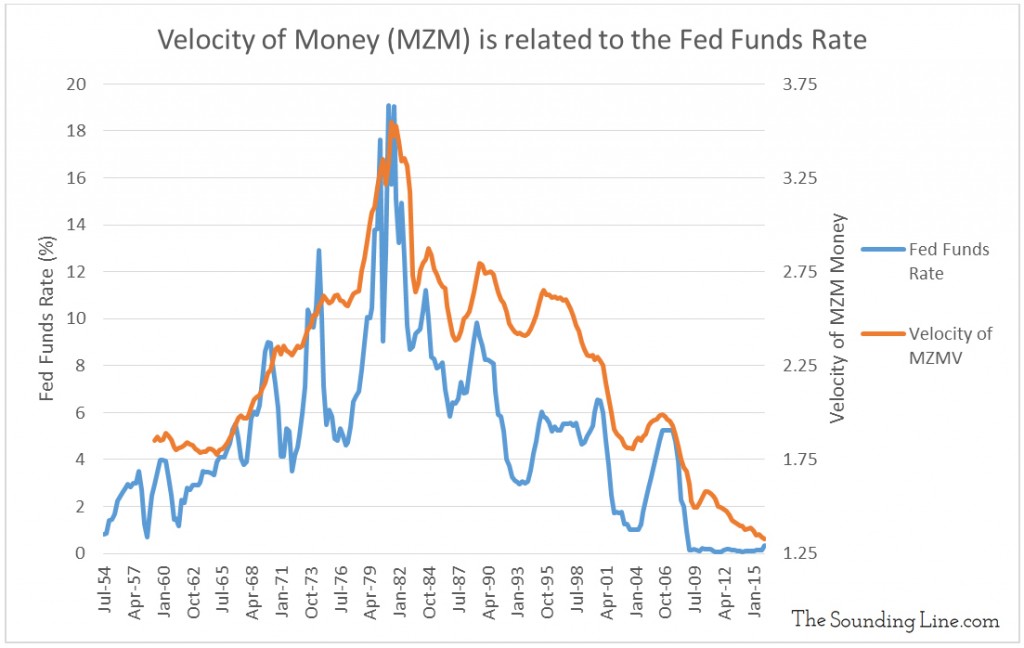

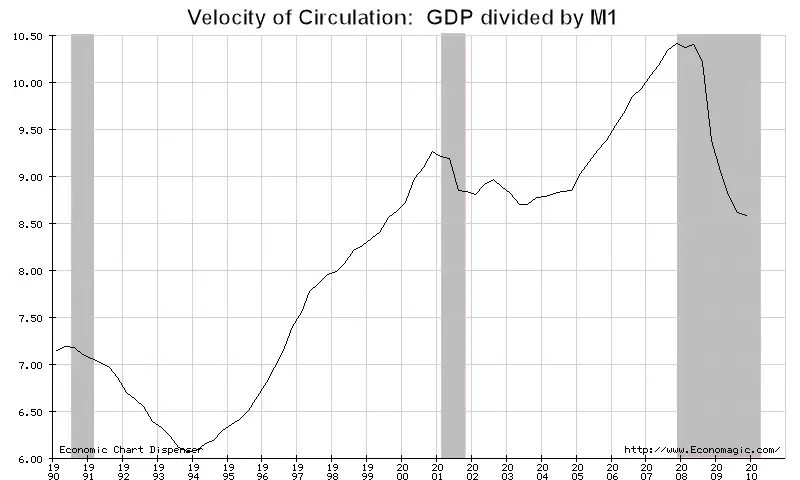

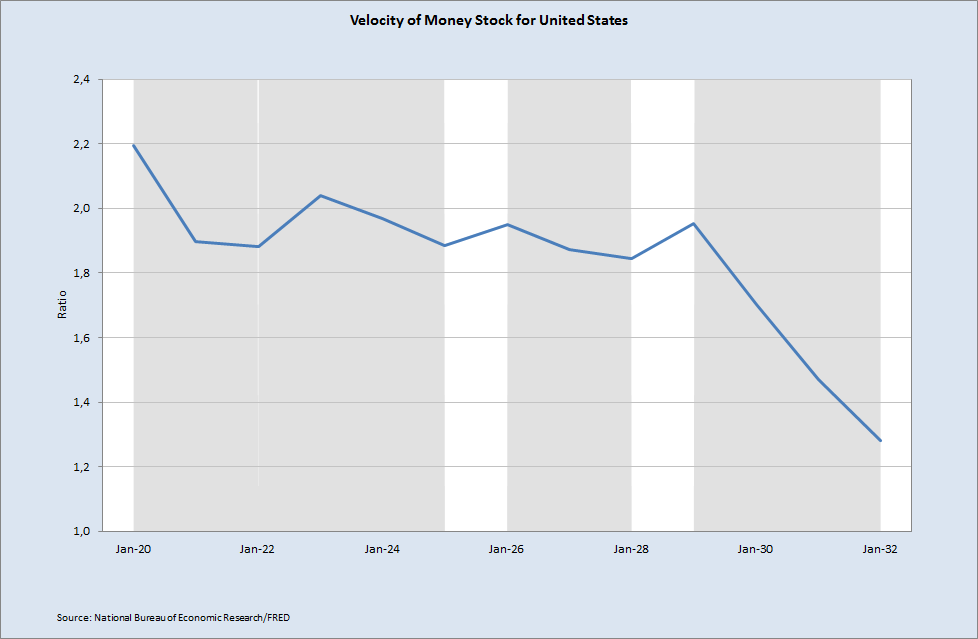

Click here to see a chart for the m1 velocity of money. May 24 2020 at 8 41 pm in q1 of 2020 the velocity of money further decreased. Therefore the calculation of the velocity of money is as follows 2525 00 1345 00.

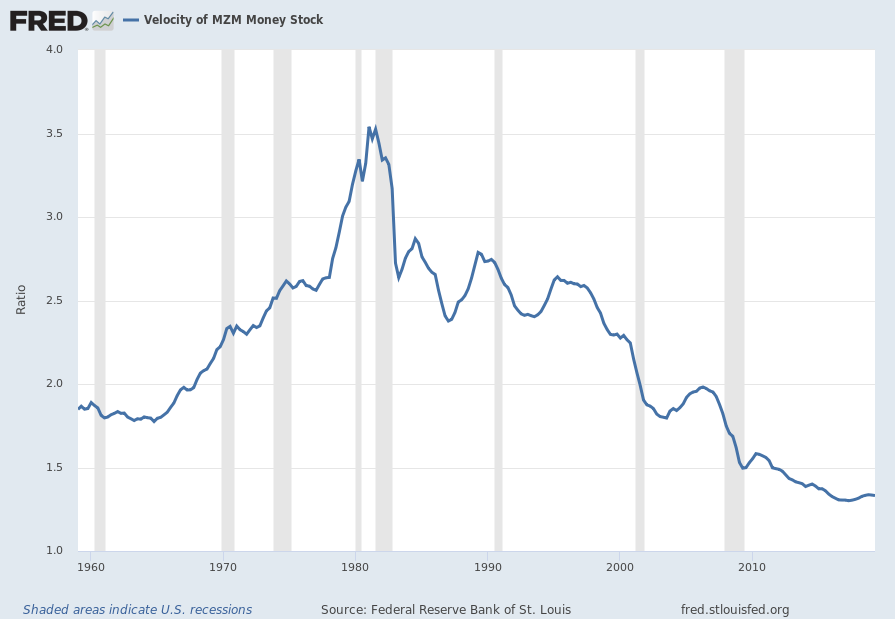

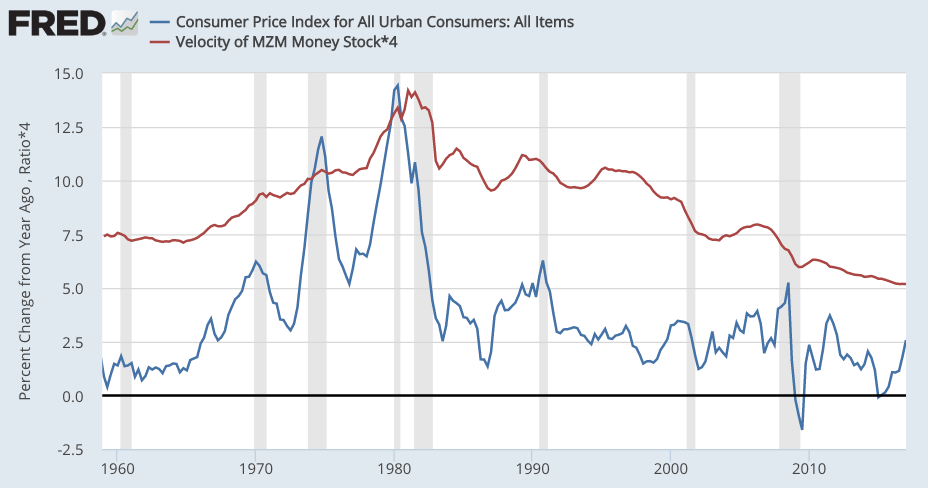

Use the below given data for calculation of the velocity of money. The question of course is will this large decline in the velocity of money persist. Louis fed depicting the velocity of money in terms of the mzm m1 and m2 money supply measures.

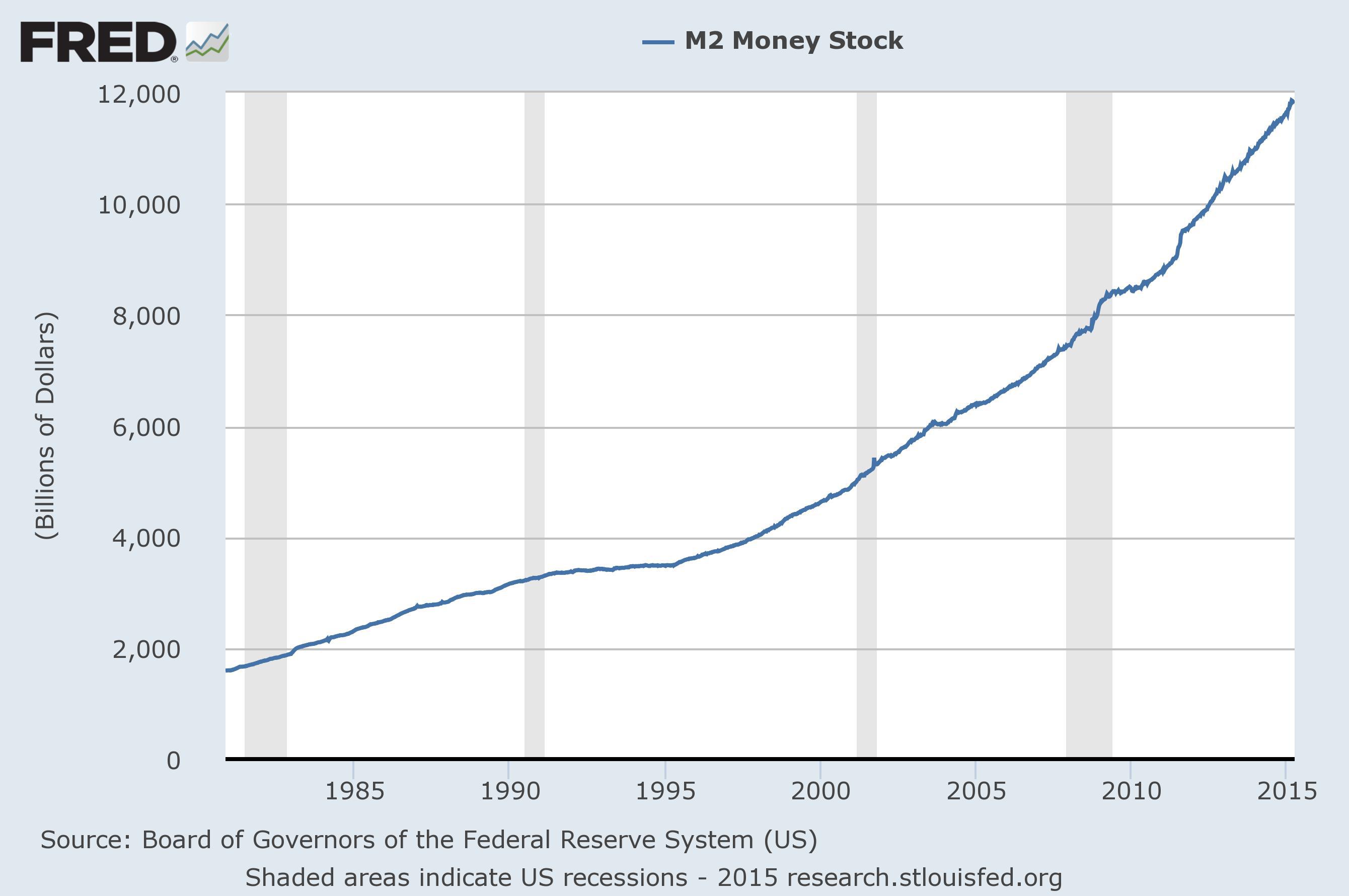

All charts reflect quarterly data through the 1st quarter of 2020 and were last updated as of april 29 2020. Equals m1 plus savings deposits money market deposits and time deposits less than 100 000. For many m2 is the figure to watch in forecasting inflation.

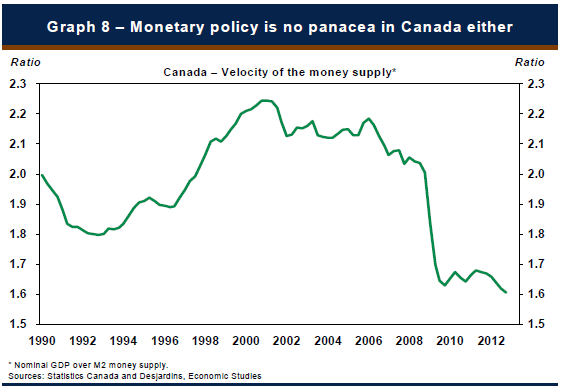

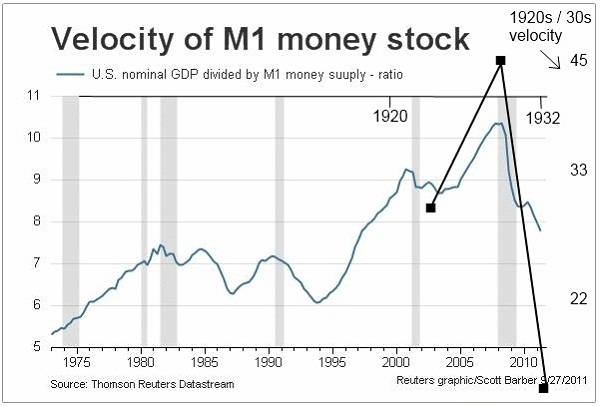

If the velocity of money is increasing then more transactions are occurring. That s one reason there has been little inflation in the price of goods and services. Equals the monetary base m0 plus checkable deposits and traveler s checks assets that can be used to pay bills and debts.

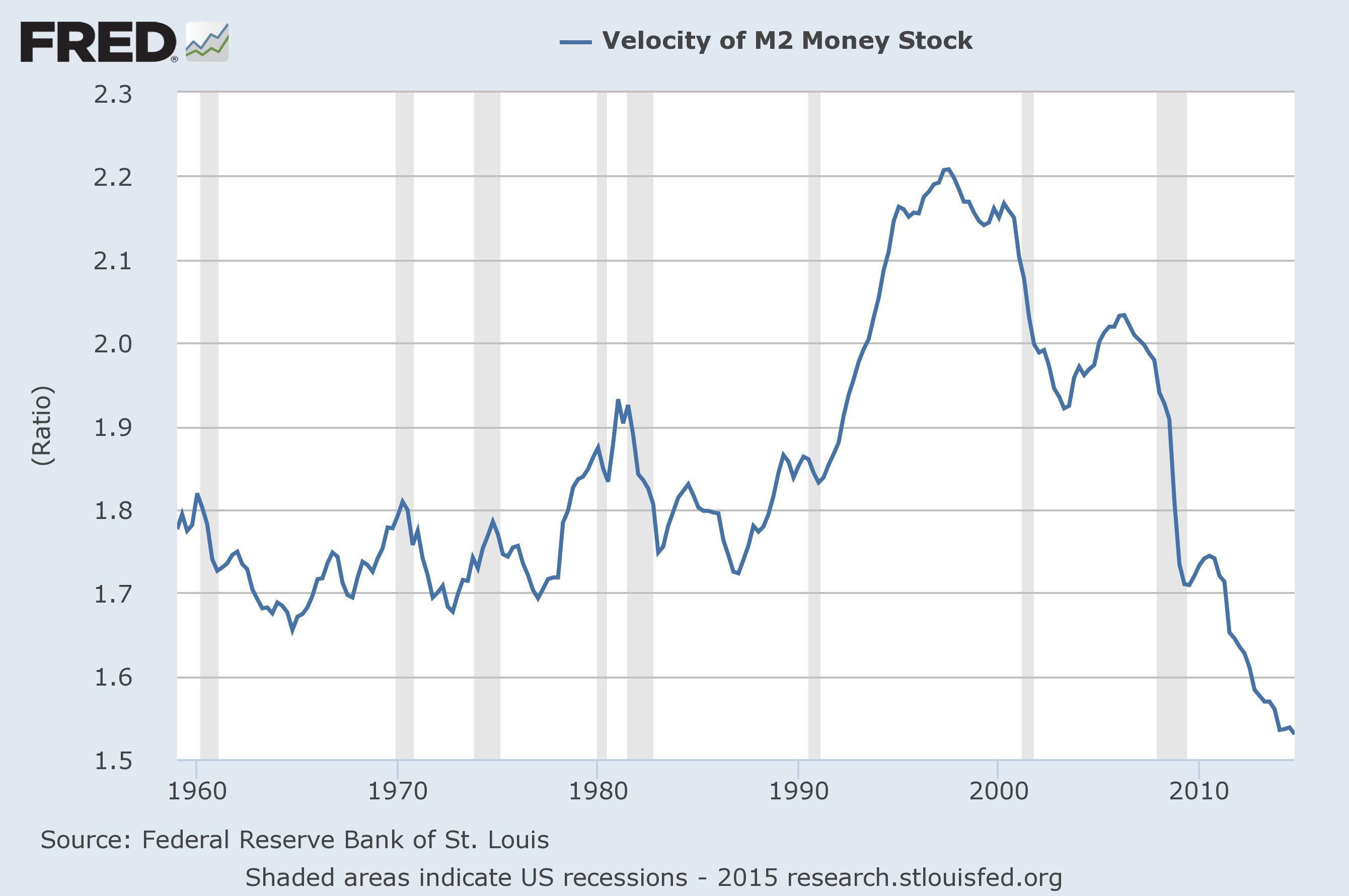

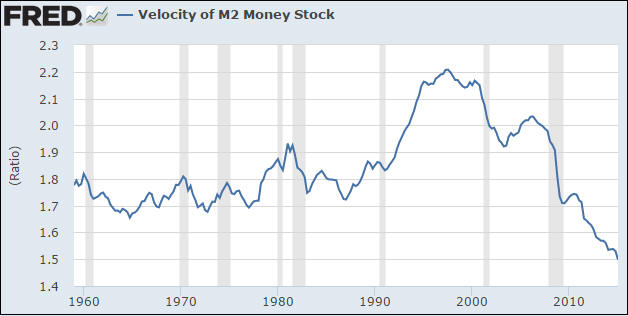

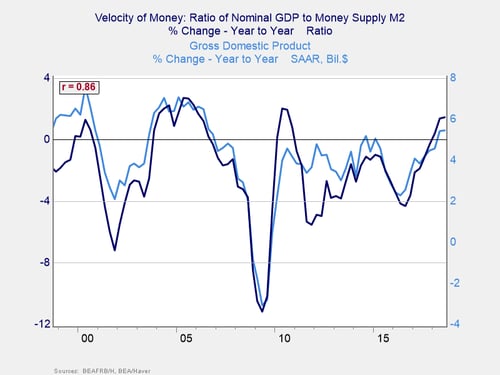

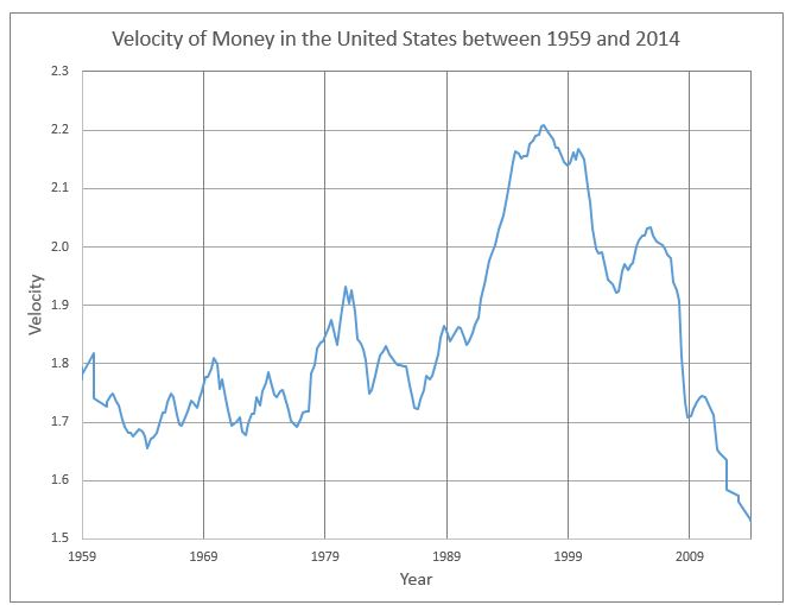

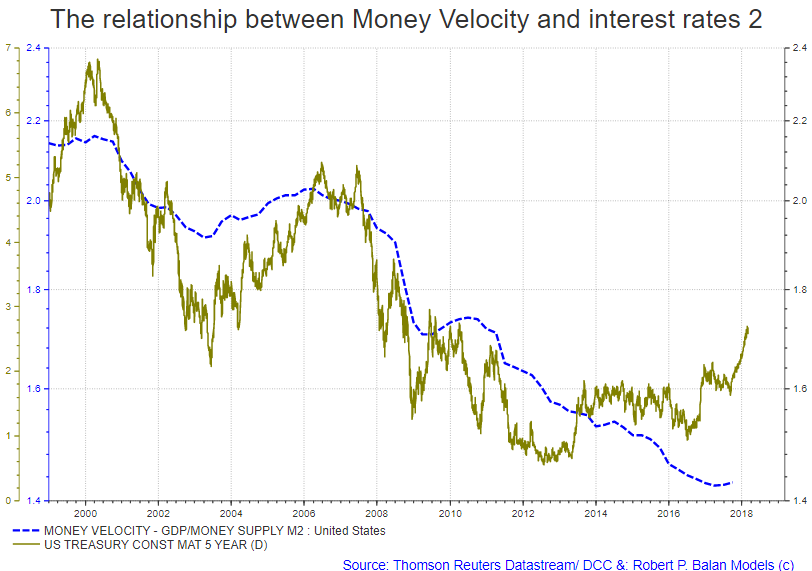

In other words it is the number of times one dollar is spent to buy goods and services per unit of time. Money velocity velocity is a ratio of nominal gdp to a measure of the money supply m1 or m2. This chart shows you the decline in the velocity of money since 1999.

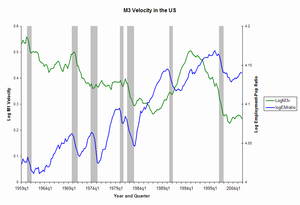

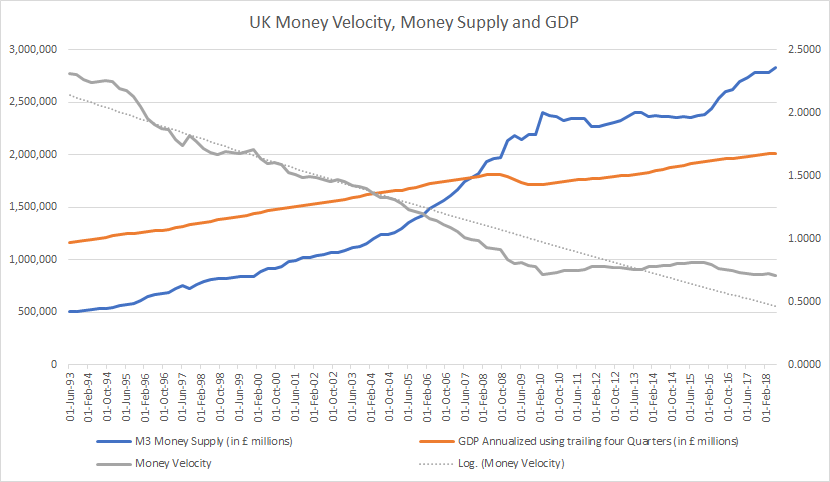

The us no longer publishes official m3 measures so the chart only runs through 2005. It can be thought of as the rate of turnover in the money supply that is the number of times one dollar is used to purchase final goods and services included in gdp. As n gdp falls creating an excess of savings over investment outlets more savings end up in the payment s system.

As money velocity is destroyed future income streams are lessened. The velocity of money or the velocity of circulation of money is a measure of the number of times that the average unit of currency is used to purchase goods and services within a given time period. It also shows how the expansion of the money supply has not been driving growth.

When data for v is updated for this current period we expect to see a similar decline. The second chart below shows what happened to the velocity of money after the 1929 crash.